We work with clients from a diverse range of backgrounds and circumstances. Some with expert insights into the economy and others that are borderline financially illiterate.

What we aim to provide for all our clients is clarity, through education and proven strategies.

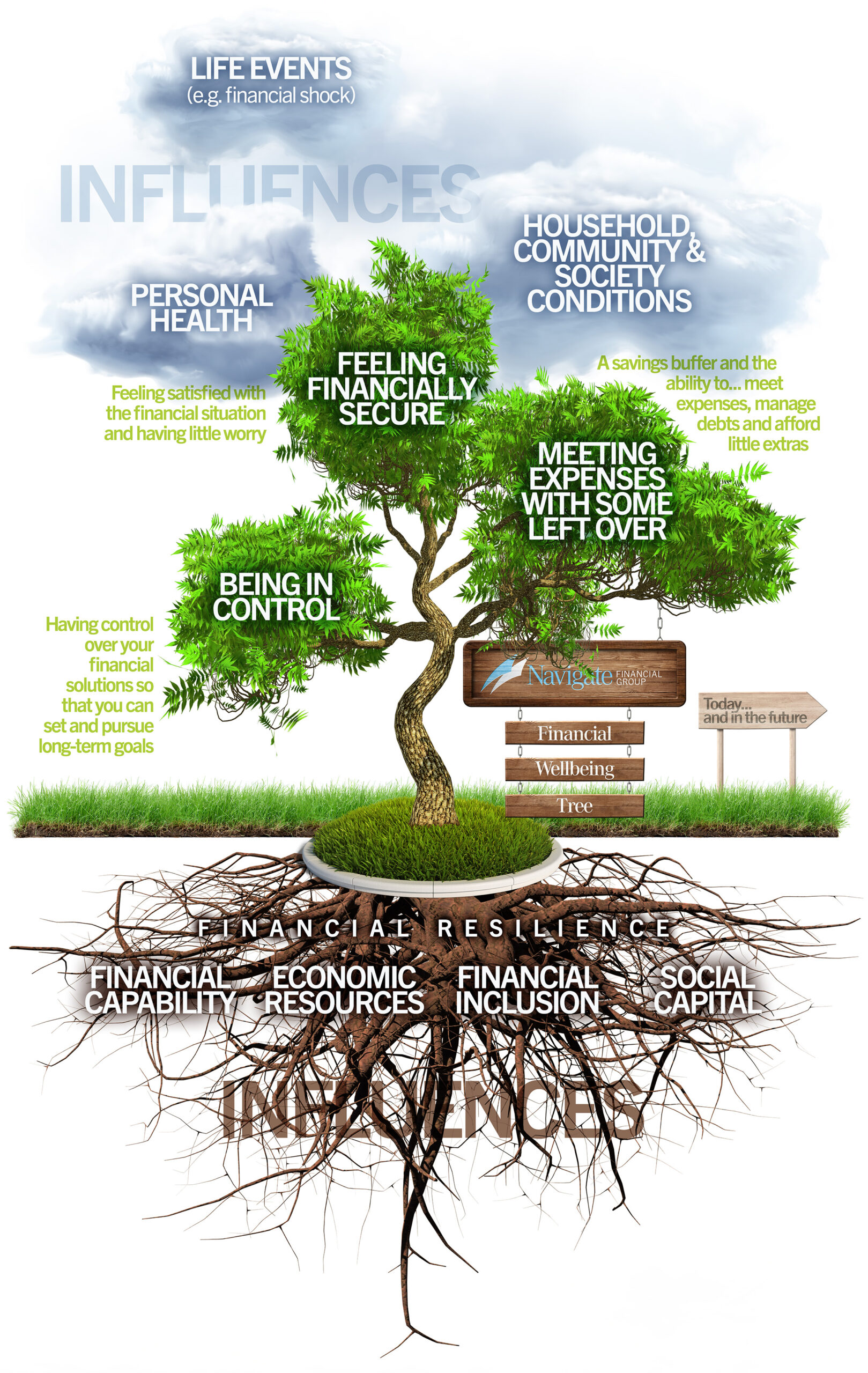

Strategies that safeguard their interests, build confidence in their approach and ultimately provide a greater sense financial wellbeing.

What financial behaviours are most influential for financial wellbeing?

Future financial planning behaviours

e.g. regular savings contributions, paying off more than minimum amounts on credit cards and mortgages, additional contributions to superannuation, investing surplus

Financial

self-efficacy

e.g. the extent people feel they balance their spending and savings, are organised with money and have money aside for later, target savings goals

The four elements to financial wellbeing

In particular, people’s financial wellbeing is most affected during transitional or life course events, such as moving out of the family home, getting married, getting divorced, having a baby, changes to employment status, income and retirement.

While these are the triggers when most seek advice, the value of having in place a financial plan and ongoing relationship with an adviser provides financial capability – which is a combination of enhancing financial knowledge, attitudes, decisions, and behaviours, which influences how a person manages their finances and the decisions or actions they take.

By providing knowledge and working as a mentor with our clients we are able to deep-root these ideals and impart confidence that they are on the right path to their version of prosperity while feeling secure.

Feel free to contact one of the team at Navigate Financial Group to get a complimentary health check for your financial wellbeing.

Disclaimer: This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.

References:

https://assets.csi.edu.au/assets/research/Exploring-Financial-Wellbeing-in-the-Australian-Context-Report.pdf

https://files.consumerfinance.gov/f/201501_cfpb_digest_financial-well-being.pdf